Spotlight

The digital asset industry experienced an impactful week, driven by significant legislative and market developments. A key catalyst was President Trump's recent executive order, which aims to expand access to alternative investments, such as cryptocurrencies and privately owned companies, within 401(k) retirement plans. This initiative is seen as a major step toward mainstream adoption and could potentially unlock a new wave of capital into the crypto market. Meanwhile, XRP (Ripple) saw a notable 12% weekly surge, eyeing a breakout above $3.18. This rally was sparked by the token's recent legal victory against the SEC, a win that has fueled a remarkable 480% year-over-year increase amid growing institutional interest.

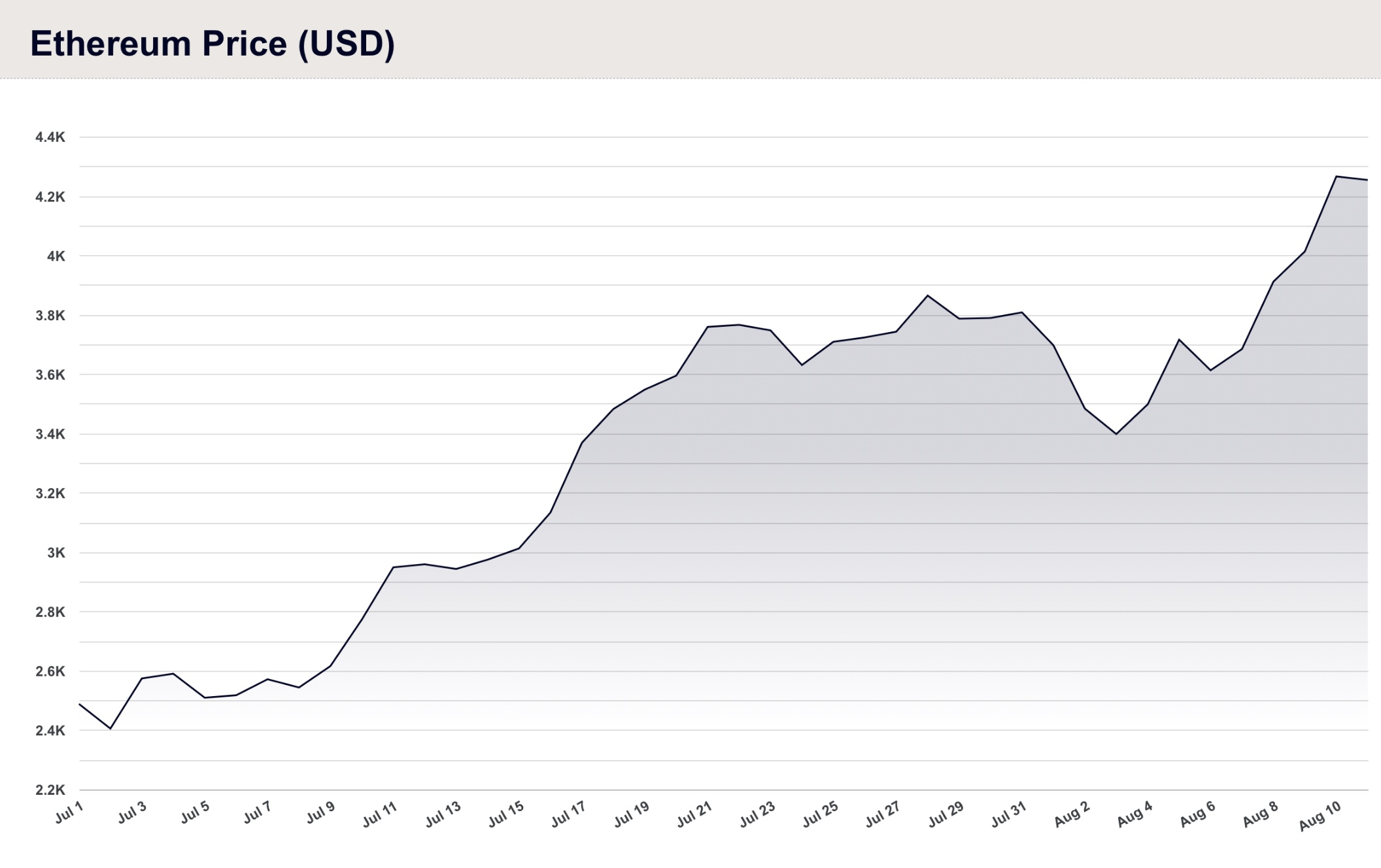

In other market news, Ethereum (ETH) stole the spotlight from Bitcoin (BTC), with its rally pushing the price above $4,000, reaching closer to its all time high. This surge was fueled by a significant increase in spot ETF inflows, signaling a rotation of capital as traders momentarily shifted their focus from Bitcoin. Despite this, Bitcoin demonstrated remarkable resilience, successfully recovering from a recent dip and climbing back to near $121,000, putting it once again close to its all-time high. The week's movements highlighted a market grappling with pivotal forces, including ETF flows, macroeconomic data, and pending U.S. legislation, setting the stage for a potentially volatile period ahead.

Ethereum Price

Ethereum's rally to over $4,000, its highest price in eight months, is primarily a result of a significant influx of institutional capital. This can be seen in the unprecedented inflows into spot Ethereum ETFs, which are now being used by major financial players to gain exposure to the asset. In July alone, these ETFs saw inflows of $5.5 billion, nearly matching the $6.3 billion flowing into Bitcoin ETFs, which traditionally dominate the market. This marks a clear shift in institutional sentiment, with firms now viewing Ethereum as a core holding.

Beyond ETFs, other data points confirm this institutional interest. On-chain analysis from July showed a combined purchase of 63,837 ETH (worth approximately $236 million) by three large wallets linked to institutional trading platforms. Another report flagged 14 new wallets that accumulated over 850,000 ETH, valued at over $3.1 billion, since early July. This aggressive accumulation points to a long-term strategic positioning by institutions who are increasingly recognizing Ethereum's utility as a "programmable platform" for decentralized finance (DeFi) and real-world asset tokenization, contrasting it with Bitcoin's role as a store of value.

Looking ahead

The upcoming market week is set to be dominated by concerns over U.S. interest rates and the fallout from new tariffs. The Federal Reserve's next move is the main event, with investors scrutinizing any new data that could signal a policy shift. This uncertainty will likely drive market volatility. Concurrently, the effects of recently implemented tariffs on global supply chains and consumer prices are a growing concern. This creates a challenging environment for investors, where the actions of central banks and geopolitical trade decisions directly impact asset valuations across traditional and digital markets, including Bitcoin's role as a potential hedge against economic instability.

Teroxx Decoded

Bitcoin has demonstrated remarkable price growth when compared to traditional financial (TradFi) assets and even its crypto counterpart, Ethereum. The graph, which tracks the price performance of various assets over a period of several years, shows that Bitcoin has significantly outperformed the S&P 500, the NASDAQ, Gold, and Oil. This robust performance underscores the asset's ability to generate high returns, a key driver for investor interest. While all assets experienced periods of volatility, Bitcoin's upward trajectory has been the most aggressive, particularly in the later part of the timeline, showcasing its potent growth potential.

The data visually confirms Bitcoin's position as a high-growth, high-risk asset class. Its steep rallies and sharp corrections highlight its unique market dynamics, which are distinct from the more gradual movements of traditional indices and commodities. For investors, this powerful performance is a testament to the strong market demand and increasing institutional adoption, positioning Bitcoin as a potent, though volatile, component for portfolios seeking aggressive returns. While other assets have delivered steady growth, Bitcoin's parabolic moves have solidified its reputation as a leading performer in the modern financial landscape.

.jpg)